In our rapidly evolving digital age, technology has transformed several aspects of our lives, and managing our finances is no exception. A standout innovation in finance have been the instant loan app. These apps have become a beacon of hope for those caught in unexpected financial difficulties.

Let’s delve into how these apps have turned into a vital aid for many, offering swift and handy solutions during financial crunch times.

Loan App – Get Cash Instantly:

One of the biggest pluses of instant loan apps online is how quickly they get you the money you need. Fill out forms, undergo credit checks, and wait seemingly forever for approval? That’s the old, traditional way of borrowing. Instead, these modern, digital platforms use tech to make the whole process so much easier. They can even get you approved within minutes! This speedy solution can be a life-saver in urgent situations, like when you are suddenly faced with medical bills or need immediate repairs on your car.

Convenience at Your Fingertips:

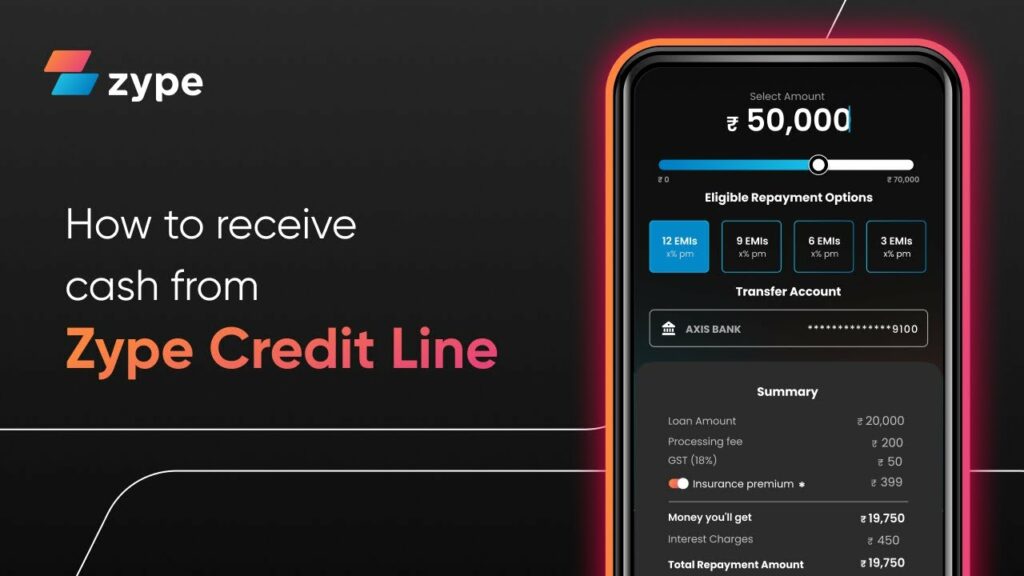

Online instant loan app India make borrowing money incredibly convenient and straightforward. These apps are created with the user in mind; their intuitive interfaces are easy to navigate, making the application process a breeze. You can apply for a loan whenever and wherever you want, right from your smartphone or computer. This easy access is what really sets them apart, especially in times of urgent financial needs. You can secure the money you need without leaving the house or skipping the traditional trip to the bank or lending institution.

Minimal Documentation and Red Tape:

Traditional lending processes often involve a cumbersome documentation process, requiring borrowers to submit a plethora of paperwork. Online instant loan app personal, however, have revolutionized this aspect of borrowing. Most of these apps require minimal documentation, often limited to basic identification and income proof. This reduction in red tape not only expedites the approval process but also makes loans accessible to individuals who may not have an extensive financial history.

Tailored Solutions for Various Needs:

Instant loan apps available online can be true lifesavers. They offer various types of loan products tailored to suit all kinds of financial needs. Maybe it’s a quick personal loan you’re after, emergency cash to tide you over, or perhaps an installment loan to spread out the repayments. These platforms provide the flexibility to pick the loan type that best matches your needs, ensuring you find the financial solution that’s right for your particular situation.

Inclusive Accessibility:

One great thing about online easy EMI loan apps is that they’re a lot more open-minded when it comes to lending. Traditional banks can often be pretty strict about who they lend to, which makes it tough for people who don’t have a long credit history or get their income in less typical ways to get a loan. But online loan apps turn this on its head. They use some really smart methods and alternative data to determine if you’re good for a loan, throwing a financial lifeline to a much wider range of people who need funds.

Conclusion:

Wrapping up, online instant loan apps have popped up as a saving grace for many, offering immediate financial help during tough times. They’s a revolution in the lending world, giving quick access to money, convenience, and customized solutions with little paperwork. No doubt, these apps have become an emergency go-to, but remember to use them wisely, keeping the terms in use in mind.

With technology’s steady march, these apps are bound to become even more central in catering to the changing financial needs of people all over the world.